Santander charged commissions for 24 years to Fernando's father for an endorsement that does not appear after his death

Fernando went to the Santander Bank branch at the beginning of last year on Franchy Roca Street in Las Palmas de Gran Canaria with the aim of closing his father's current account, who died in October 2023. Before, he should, however, had to find out why the financial entity charged him a commission of 50 euros every two months (300 per year). He only knew that he was related to an guarantee that his father had requested a quarter of a century ago, in 1999, as a guarantee to cover an eventual payment obligation within the framework of a judicial procedure. In addition to that commission, the bank was loaded every month for twenty euros for the maintenance of the account.

Fernando knew the existence of the guarantee when he was granted the writing of acceptance and award of the inheritance, in early 2024. He barely had two data. The court in which the cause for which his father had requested the guarantee was the first instance 10 of Las Palmas de Gran Canaria was processed. And the guarantee was valued at 6,701.28 euros on the date of death. I did not know why I had asked. Nor did I know what that judicial case was obeyed for more than 25 years ago. Not even your procedure number. He could not consult, therefore, how he had concluded. The time elapsed and the removals that had happened in that period made it very unlikely to find the original contract between the belongings that his father had left.

As informed, a certificate of cancellation of the guarantee was necessary to close the account. And to cancel the guarantee, the bank asked the heirs to the original of the contract or a letter from the beneficiary with the application, which was already impossible. Fernando went to the Franchy Roca branch up to four times to provide a copy of the contract, but all attempts were unsuccessful.

In the absence of responses and solutions in those offices, he resorted to the Santander claims service. “It could not be located the copy of the guarantee. The Court, as a beneficiary, has the original,” the entity replied in May 2024. In the city of Justice it also received a negative response: “There is no endorsement of the year 1999”.

With his claim to Santander, Fernando made the entity's central services give the instruction to the Franchy Roca branch to stop loading the settlements for the maintenance of the guarantee. The bank returned what he had charged for this concept since his father's death. Also the maintenance commissions of your account. By then, Fernando had already contacted the Bank of Spain to tell all these vicissitudes to the supervisory organ of the banking system.

“I cannot access the account, but the collection notifications come to the mobile. I am seeing that 20 euros return to me, then another 20, another 20 … (corresponding to the maintenance commission of the account). Then, the same but 50 in 50 (commission of the guarantee).” In total, the entity has reinstated about 600 euros.

Ear pull of the Bank of Spain

The guarantee contract, however, still does not appear. And, therefore, Fernando continues without knowing why they were charging his father a commission of 300 euros a year for more than two decades and, consequently, if those charges were due or improper. The endorsement had to be extinguished when the procedure was closed in the Court of First Instance. The problem is that it is not known when that cause ended because you do not even know the procedure number. His lawyer has gone to the courts several times. He has even consulted the Deanery. “It doesn't come out, there is none,” says the lawyer.

Given this scenario, Fernando filed a claim against the Bank of Spain. The Department of Behavior of Entities of this Supervisor body spoke in a non -binding report dated July 31. He concluded that Santander had departed from the good practices and financial uses for not conserving a copy of the guarantee, “considering that he would have been liquidated, presumably for years, from the formalization of the aforementioned contract (1999) until the date of death (2023) of the deceased (Fernando's father), commissions associated with the maintenance of the aforementioned guarantee.”

The Bank of Spain reproaches Santander not to have provided a copy of the contract of the current account of Fernando's father or the controversial guarantee, thus preventing analyzing whether the claimant “is empowered or not” to close the account.

“This department is not competent to assess, decide or pronounce on the possible damages that could have been caused to the clients and users of the financial services. These issues may submit, if the claimant party, the corresponding judicial bodies,” the corresponding bank of Spain.

The Bank Acata, but does not rectify

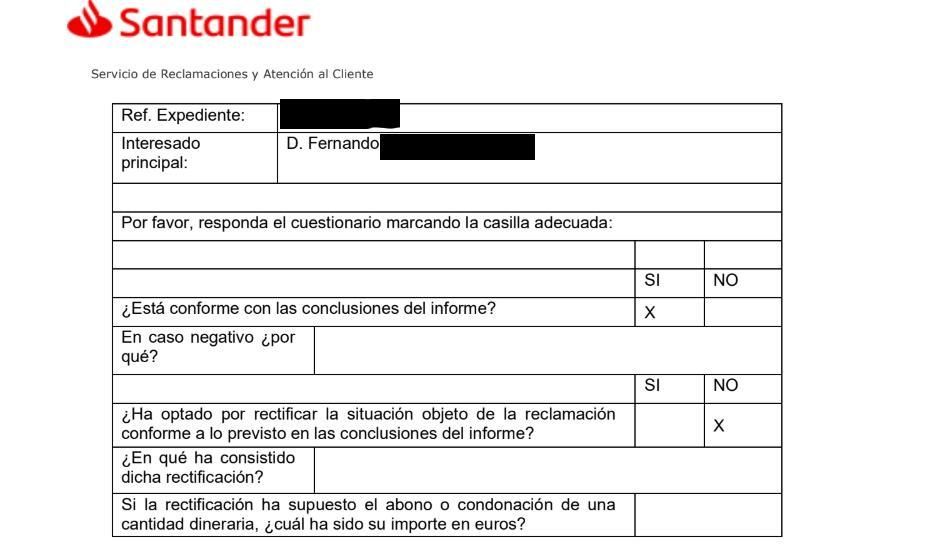

Santander has already answered the Bank of Spain report. The entity claims to be in accordance with the conclusions of that non -binding resolution and abide by “to the future to redirect the action and proceed accordingly in matters of this same nature.” However, in the form attached to the acknowledgment of receipt marks with a “no” the box in which it is asked if “he has chosen to rectify the situation object of the claim in accordance with the provisions of the conclusions of the report”.

Fernando is considering going to the judicial route to claim previous amounts. If the commissions amounted to 300 euros per year and the bank charged them for 24 years, the total figure could exceed 7,000 euros. Although the Bank of Spain's report is not binding, it can be relevant to an action in the courts.

“They return the amounts after the death of my father referring to commissions charged from the guarantee and the maintenance of the account, but they do not say” MU “of the commissions for the endorsement prior to the death and which, as indicated by the Bank of Spain in the second conclusion of the opinion issued, have been charging from the Constitution of the endorsement in 1999 until October 2023 (date of death of their father),” he says. And he adds: “They have no idea what they have charged, but at the branch, despite having spoken with them up to four occasions, they never wanted to stop the collection of those commissions.”

Fernando says that the bank has reloaded in recent months the twenty euros for the maintenance of the account, where a receipt is still domiciled.

From Santander they have indicated to this newspaper that the entity does not speak of specific cases for data protection, but that the mandatory period to conserve bank documents depends on multiple factors, as of its type or territory, and that when a contract is lost, a retreat of commissions is reached. That is, they are returned. In the case of Fernando, only those after the death of his father.

Entity sources also argue that customers can request the cancellation of the account even if they do not have the contract, “but the application has to arrive. If the request for cancellation of the account does not arrive, you cannot.” However, Fernando stresses that to close his father's account, they ask for the certificate of cancellation of the guarantee. And that, therefore, not knowing anything about that guarantee and having not preserved the bank, it cannot carry out the process. This newspaper has asked the financial entity for this particular assumption, but to date it has not obtained an answer.

Aval duration

From the Financial Users Association (ASUFIN), they explain that, in general, financial institutions have the obligation to preserve documentation during the time of validity of the contracts and, at least, the term of five more years of contractual responsibility if there are tax obligations.

In its article 30, the Commercial Code imposes on merchants and entrepreneurs the general obligation to preserve the documentation of their businesses for a period of six years from the last seat made in the books, in their accounting.

A sentence issued by the Supreme Court in 2021, in a judicial procedure that was substantiated in Granada, concluded that financial entities have the obligation to deliver the contractual documentation so that the client can verify if the agreed has been properly reflected during the execution of the contract. According to this resolution, the client can request it at any time as long as that relationship is maintained.

Asufin adds that guarantee contracts, “being accessories, are extinguished when the obligation it guarantees is extinguished.” The endorsement of Fernando's father had an indefinite duration. It was subject to the duration of the judicial procedure that was substantiated in the first instance 10 of the capital of Grancanaria. His family does not know at what time and how that judicial procedure was closed, but, as his lawyer affirms, he does not seem logical that he would last 24 years, that he was still open when he died. “Beyond a year and a half it should not be extended,” says the lawyer.

Fernando feels an “absolute helplessness.” “I feel that I have been toured, that they have hesitated me. Without a copy of the contract I cannot do anything,” says this citizen, who stresses that Santander had the obligation to keep the document and denounces the deal dispensed during this time at the Franchy Roca branch.